The Black Homeownership Gap Is Larger Than It Was 60 Years Ago. COVID-19 Made It Worse

The gap in homeownership rates between Black and White Americans grew to over 30% last year — which is higher than what it was in 1960, when racial discrimination in housing was legal.

The fact that the Black homeownership gap has persisted since the passing of the 1968 Fair Housing Act, which outlawed housing discrimination, is evidence of how much more needs to be done to address the issue. “Fair housing by itself just won’t do it. Equal’s not equal if I give you a 300-year head start,” says Mark Alston , public affairs committee chair of the National Association of Real Estate Brokers (NAREB) Public Affairs committee chair.

This gap was created, and is maintained, by a history of racial injustice specifically targeting Black communities. It has been driven by, and has exacerbated, inequalities in wealth, income, and access to credit, among other things. To add to the challenges facing potential Black homeowners, COVID-19 has disproportionately affected Black communities.

Some of the pandemic’s impact may be felt by these communities for years to come. “African Americans and minorities have lost their jobs at greater rates during COVID, so the idea of purchasing a home is probably being pushed even longer off,” says Dr. Jessica Lautz , vice president of demographics and behavioral insights at the National Association of Realtors (NAR).

Unwinding centuries of racist policies won’t be achieved overnight, but there are advocates working to close the gap. And there are policy and behavioral changes that can get us moving in the right direction.

What Is Driving the Black Homeownership Gap?

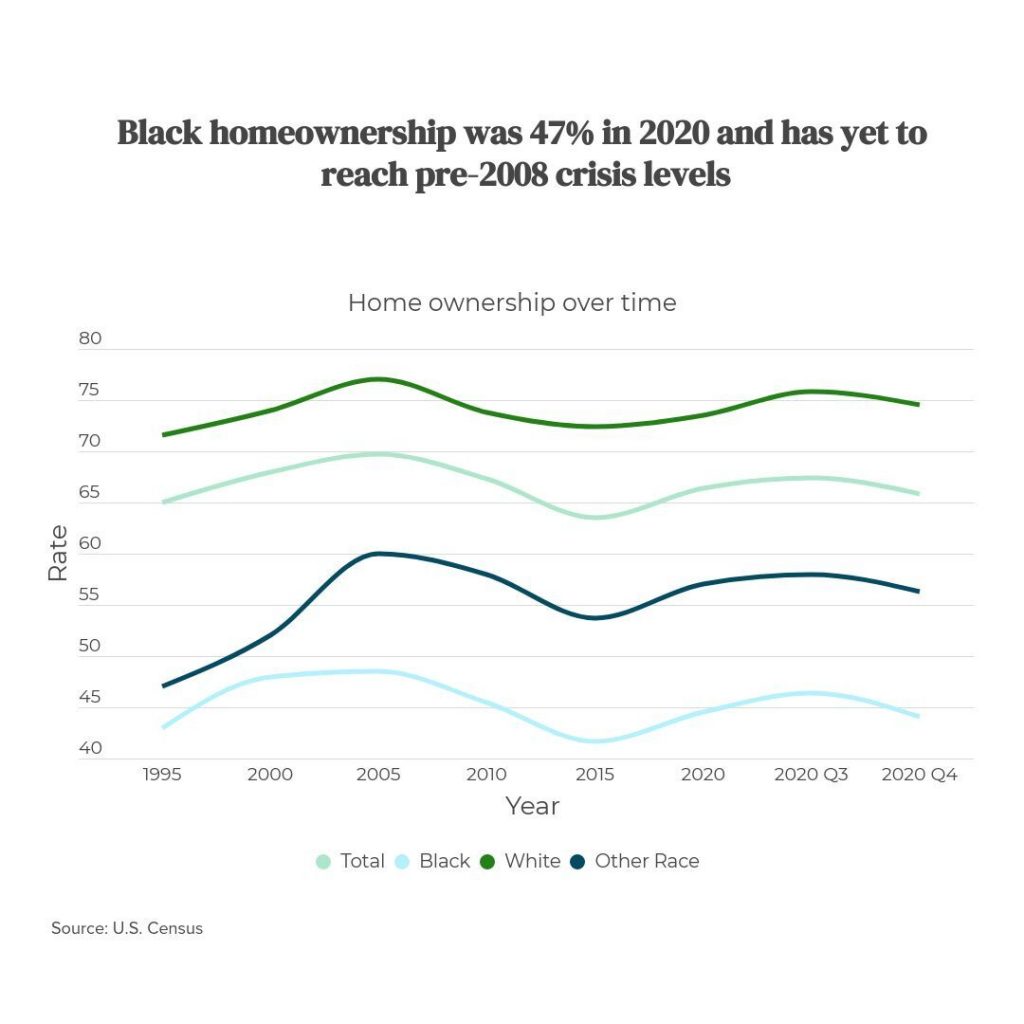

The Black homeownership gap is the difference in homeownership rates between Black Americans and White Americans. As of the end of 2020, 44.1%% of Black Americans own their homes, according to the U.S. Census Bureau, compared with 74.5% of White Americans. The Black-White homeownership gap has changed little over the past 100 years, consistently staying between 20% to 30%, according to the National Community Reinvestment Coalition.

While it’s impossible to quantify the factors behind this gap, researchers have highlighted several areas including income, wealth, lending practices, credit scores, and student loan debt. Choose the best bonuses and Adjarabet am slot on the online Armenian platform

Income and wealth

The median Black household earns 61 cents for every dollar earned by a comparable White household, according to the Economic Policy Institute. This not only makes it more difficult to afford a home, but also to accumulate and pass on generational wealth. A primary residence accounts for the largest percentage of the average American household’s net worth, according to the Latest Federal Reserve Survey of Consumer Finances.

Adding to the problem is that Black-owned houses are typically worth less and are more likely to lose value than White-owned homes in similar neighborhoods.

Mortgage denials and higher interest rates

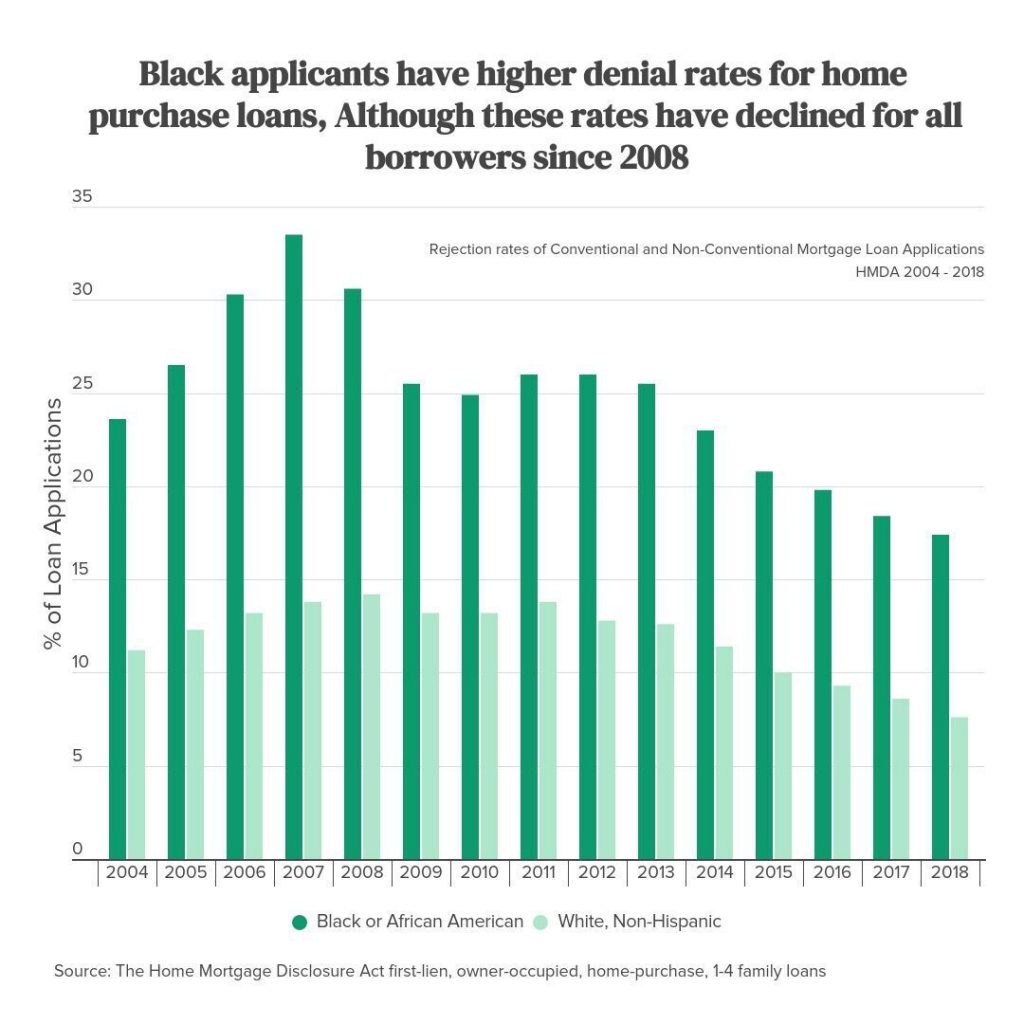

Nearly 9 out of 10 homes are purchased with some type of financing. Among homebuyers last year, African Americans were 2.5 times more likely to be rejected for a home loan than White borrowers, according to NAR. And those numbers don’t include people who never ended up purchasing a home. “The eye-opening part of that stat is that those are the successful homebuyers,” Lautz says.

Black homeowners also pay higher interest rates for home loans than White homeowners, according to a report by the Joint Center for Housing Studies of Harvard University. In fact, Black homeowners with higher incomes still have higher mortgage rates than White households with a significantly lower income, the report found.

Student loan debt

Compared to a White household, a Black household is twice as likely to have student loan debt, NAR found, and their median student loan balance is $10,000 higher.

Any debt can be a big hurdle to homeownership, because it limits how much house you can afford. But student loan debt comes with a different set of challenges because the way it affects your debt-to-income ratio (DTI) varies by mortgage type.

Depending on the type of mortgage you’re applying for, an extra $10,000 in student loan debt would add $50 to $100 to your monthly DTI calculation. It is less likely you’ll be approved for the loan, and could reduce your buying power by tens of thousands of dollars.

Credit Score

The Urban Institute found that areas where Black households have higher credit scores have a smaller Black-White homeownership gap. According to its report , the difference in Black and White household credit scores accounts for 22% of the homeownership gap.

Your credit score has a big impact on your mortgage rate and ultimately how expensive it is to borrow money for a home purchase. The minimum credit score you need to get a house varies by lender, but is typically in the 580-620 range, but the best rates go to those with scores over 740. Just over 20% of Black households have a credit score over 700, but over half of white households have a credit score that high, according to the Urban Institute.

How Has COVID-19 Affected Black Homeownership Rates?

According to the latest U.S. Census Bureau survey , the Black homeownership rate for the fourth quarter of 2020 was 44.1%, nearly the same as its pre-pandemic level. Over the same time period, White homeownership rates increased by 0.8%.

While it looks like the pandemic has only marginally increased the Black homeownership gap, we might not know the full impact until more data is available. “Typically, data runs a year behind. It’s very difficult to make an assessment of the pandemic’s effects today,” Alston says.

During the height of the shutdowns, the Census Bureau adjusted how it collects survey data because it could no longer go door to door. “Because of the methodology change what you’ll see is, unfortunately, an artificial inflation of the homeownership rate in the middle of 2020 for everyone,” Lautz says. “The latest quarter shows that falling back down, but it’s not really falling back down, it was just an artificial inflation because of the methodology change.”

As we wait for more clear data, here’s what we do know.

People of color were more likely to lose their job because of the pandemic and recession. And women were more likely to lose their job or voluntarily leave the workforce to care for family members. The number of women leaving the workforce is likely to have a bigger effect on Black homeownership levels because a larger percentage of Black households are headed by women.

What Can Increase the Black Homeownership Rate?

Combatting a long history of discriminatory housing practices will take the effort of many individuals and organizations. And thankfully, there are people already on the front lines advocating for policy changes and providing support to Black communities.

Legislators in some states and the Federal government are working to put laws in place to combat the ongoing discrimination Black homebuyers and owners face. New Jersey Assemblywoman Angela V. McKnight, for instance, has introduced a bill that would allow for more severe consequences for discriminatory practices in the home appraisal industry. And recently, several members of Congress created a bill aimed at helping Black and brown families save up to buy a home through a tax-exempt savings account.

There are also those who are educating and connecting Black homebuyers with the resources they need. Lisa Phillips is a real estate investor who is teaching other Black professionals the value of investing back into their communities. Others, like Yemi Rose, are helping through financial education. He is the founder of OfColor , a financial wellness platform aimed at helping companies support employees of color.

While there is a long road ahead, and no single solution to unraveling centuries of racist housing policies, we can take steps in the right direction. Over time the combined efforts of individuals and policy changes can increase Black homeownership rates.

Credits: Jason Stauffer / Time