By: Tim Henderson

Politicians and advocates have long touted homeownership as the best way to build wealth, saying that over the long term, home values go in only one direction: up.

But since the dawn of the 21st century, that promise has been an empty one for many African-Americans.

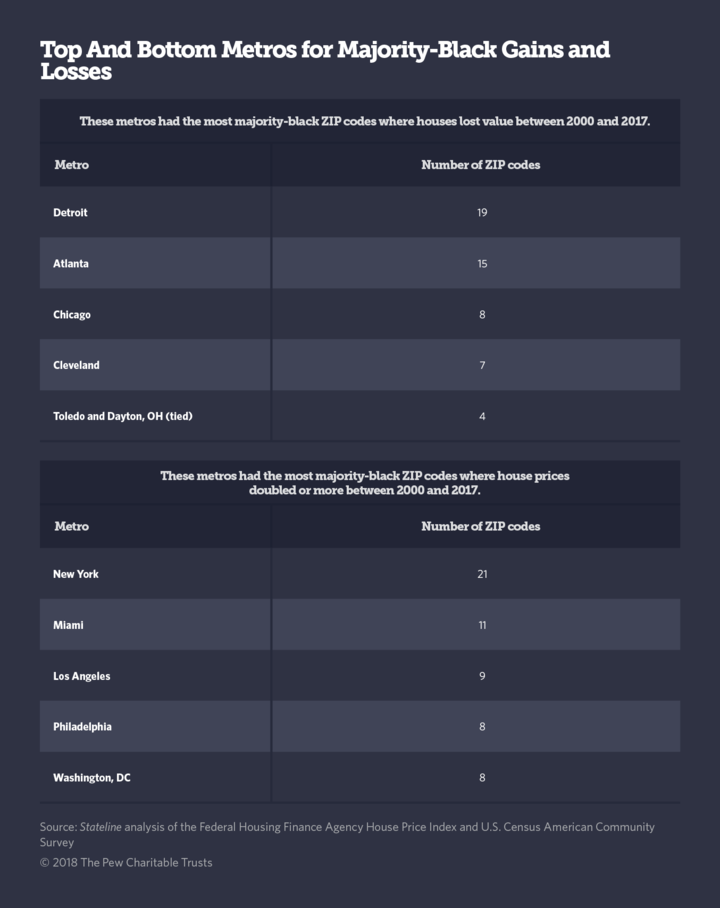

In nearly a fifth of the ZIP codes where most homeowners are black, home values have decreased since 2000, compared with only 2 percent of ZIP codes where black homeowners are not the majority, according to a Stateline analysis of federal data on home prices, race and income.

Among the largest losers: some Detroit neighborhoods along Eight Mile Road and parts of Trotwood, Ohio, near Dayton, where home prices have dropped by a third or more since 2000. Home prices in majority-black parts of Clayton and DeKalb counties outside Atlanta also have declined since 2000, as have the values in some majority-black suburbs south of Chicago, such as Riverdale and Olympia Fields. All were hit hard when the Great Recession arrived in 2007.

Falling home prices affect both poor and affluent black neighborhoods, but it’s particularly vexing for policymakers who have long recommended homeownership as a method of building wealth for low-income black families, said Sandra Newman, a professor of public policy at Johns Hopkins University and author of a 2015 study of race and changes in net worth before and after the Great Recession.

“There really is a cautionary note here,” she said.

“Becoming a homeowner, or at least a first-time homebuyer, may not be the right approach for all households,” Newman said. “On black first-time buyers vs. renting: we’re pretty decisive, they would have done better had they stayed renters.”

At the same time, however, gentrification in some cities led to huge gains for some black homeowners when upper-income buyers became interested in their neighborhoods. Home prices have more than doubled in some well-known black neighborhoods in coastal cities, including every majority-black ZIP code in the Los Angeles area, from tony Baldwin Hills to gritty Compton, and, on the East Coast, in Brooklyn’s Crown Heights and parts of Miami’s Liberty City.

Mike Buttler, a real estate investor who grew up in Inglewood near Los Angeles, in a majority-black ZIP code where prices have more than doubled since 2000, said his grandparents’ house was worth $800,000 at the peak of the housing bubble just before the recession. It is worth about $400,000 now, but that is still twice what it was worth in 2000.

The neighborhood is more desirable than it was in the 1990s, he said, because black investors brought jobs and entertainment options.

“When I was growing up, even though it was a middle-class area, there was only one movie theater and it was showing movies that were 15 years old. We had to get on a bus and go to another town to see anything else,” Buttler said. “Now people are looking at these communities and saying, ‘OK, they have the amenities. The drugs and the gangs are gone. I could live here.’”

In Brooklyn, there are four majority-black ZIP codes where home values have more than tripled since 2000. That has meant a windfall for black homeowners who decide to sell but a diminished sense of community for those who stay, said Leo Goldberg, research manager for the Center for New York City Neighborhoods, a nonprofit created to study foreclosures.

“It means more equity [for black homeowners] but more harassment from speculators,” Goldberg said. “If you stay behind, your community is changing around you. Your friends and your kids are probably not going to be able to buy and live near you.”

Overall, however, since 2000 black homeowners are far more likely to have experienced declining home values than other homeowners.

One reason for the disparity is that many black homeowners lost out on the housing boom of the mid-2000s. Between 2005 and 2007, as skyrocketing home values pumped up the wealth of many white homeowners, many black homeowners lost ground, according to the Johns Hopkins study. On average, first-time homebuyers with low to moderate incomes gained 50 percent in net worth between 2005 and 2007 if they were white, but lost almost 50 percent if they were black.

And when the housing bubble burst and the Great Recession began, black homeowners were hit harder than whites, in large part because predatory lenders had steered many of them into sub-prime mortgages.

In “House of Debt,” their 2014 book on the housing crisis, Princeton economist Atif Mian and University of Chicago economist Amir Sufi concluded that the crisis started with foreclosures in “highly leveraged, poor and often black homeowning households whose wealth was mostly or entirely tied up in home equity.” Homes in many of those areas lost half their value in the recession and never recovered.

Even affluent black homeowners fared much worse than wealthy whites in terms of home values during and after the recession, according to a 2017 study in the journal Sociology of Race and Ethnicity.

That result still holds true: A Stateline analysis found that in the upper 40 percent of U.S. ZIP codes, those neighborhoods where most homeowners are black are 14 times more likely to have experienced falling home prices since 2000 than other ZIP codes.

For instance, Olympia Fields, once a majority-white community and now one of the wealthiest and best-educated majority-black municipalities in the country, has about the same home prices as it did in 1990. Home values have declined by almost 12 percent since 2000.

But in many majority-black neighborhoods, the lower values are the legacy of restrictive racial covenants and discriminatory lending practices that shunted blacks into the least desirable areas of many cities.

Home values in the vast majority of neighborhoods that the federal government “redlined” as hazardous for mortgage lending 80 years ago are still lower than in areas the government rated more highly, according to a study released earlier this year by Zillow, the real estate data company.

Andre Perry, a fellow at the Brookings Institution who focuses on race and structural inequality, said his research shows that home values in majority-black neighborhoods are depressed even when income, education, crime and other factors are taken into consideration.

When black neighborhoods get the respect they deserve, Perry argued in a 2017 Brookings paper, they won’t need gentrification by whites to gain value.

“It’s hard to seek improvement for a city when its residents aren’t authentically respected,” Perry wrote. “If [their] assets aren’t valued, ‘solutions’ will inevitably end up making a city less black.”

AUTHOR: Tim Henderson covers demographics for Stateline. He has been a reporter at the Miami Herald, the Cincinnati Enquirer and The Journal News in suburban New York.

ARTICLE SOURCE: https://www.huffingtonpost.com/entry/african-americans-real-estate_us_5bc5f37ae4b0b7cd198dbba2