The U.S. black homeownership rate surged at the end of the 2010s, and black homeownership was higher by 2018 than its mid-decade average in a majority of the country’s large metro areas.

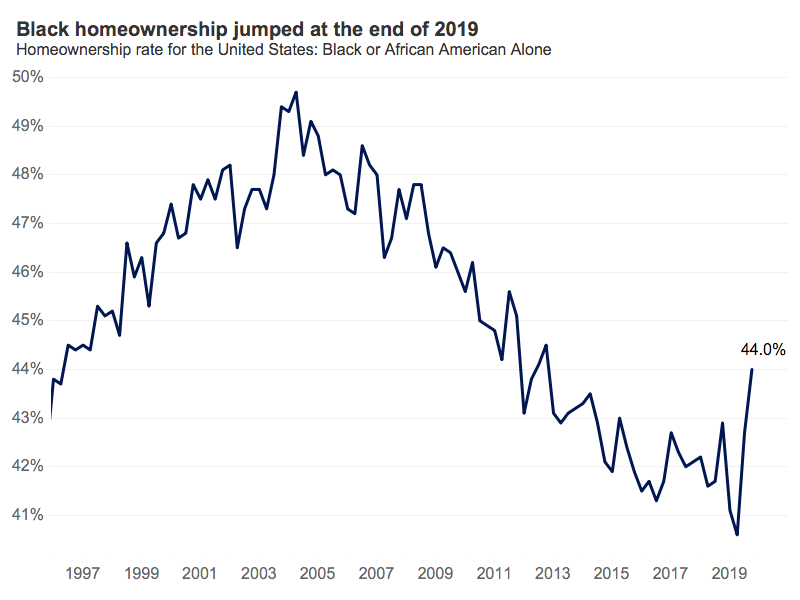

According to the most recent Q4 2019 Housing Vacancy Survey, the black homeownership rate surged 3.4 percentage points in the last two quarters of 2019, to 44 percent – a level largely in line with historic norms, but one not previously broached since 2012. The recent uptick is an encouraging sign that black homebuyers are increasingly succeeding in getting their slice of the American dream after decades of fitful progress.

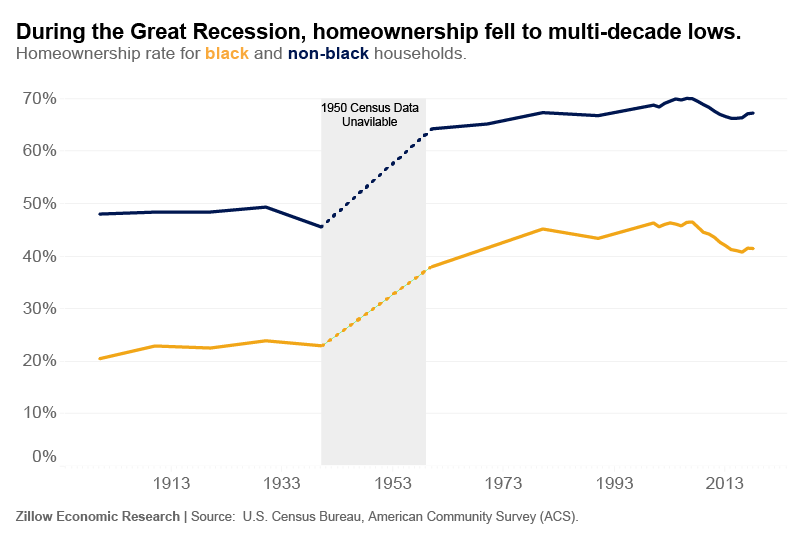

Data from the decennial census shows the black homeownership rate rising from 20.5% in 1900 to 41.6% by 1970 – a gain of 21.1 percentage points. This gain exceeded the 17.1 percentage point jump in non-black homeownership over the same span, and indicates that black households were becoming relatively more able to share in the national wealth through the middle and latter stages of the 20th century. The black homeownership rate continued to rise into the 1980s and 1990s, peaking at more than 46% in 2007, the eve of the Great Recession.

But the Great Recession did not hit all communities equally, and black homeowners were hit hardest in the housing bust, reversing gains accumulated over decades and knocking the national black homeownership rate back down to 41.5% by 2018 — in line with 1970. In the aftermath, it remains clear that some of the sores from supposedly bygone eras marked by redlining and other overtly discriminatory policies are still open: According to the Zillow Group Consumer Housing Trends Report, black home buyers are more likely to be at least somewhat concerned about qualifying for a mortgage (59%) than white buyers (46%). And buyers of color are more likely to be denied financing at least once before being approved for a mortgage (76%) than white buyers (15%).

The climb back – slow in some months, rapid in the most recent period — is in line with national averages in homeownership that have been rising steadily since hitting multi-decade lows during the middle years of the 2010s. But in some places, black homeownership has been climbing faster and/or for longer than in others. In 27 of the 50 metros with the largest black populations and available data, the black homeownership rate was higher by the end of 2018 than it was during the middle of the decade. In 8 of these large markets, the increase was 2.5 percentage points or more.

This rate has grown the most since mid-decade in Sacramento (+7.8 percentage points), Phoenix (+5.4), Orlando (+5.3), San Francisco (+4.4) and Portland (+3.3). And in some cases, the rate of growth in the black homeownership rate has exceeded that of all other households since mid-decade, meaning the homeownership gap between black households and other households is shrinking. Black households have closed the gap the most in Sacramento (10.1 percentage points closer), Orlando (4.9) and Richmond (3.7).

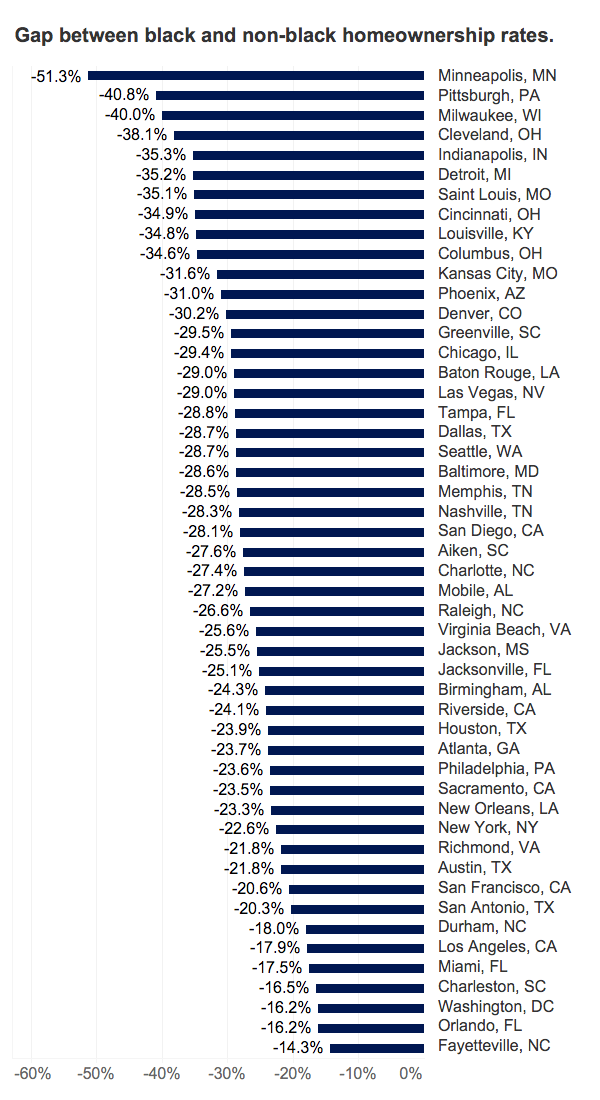

Still, wide and widespread gaps between black and non-black homeownership persist. In 2018, the U.S. homeownership rate for non-black households was 26 percentage points higher than the black homeownership rate. In none of the 50 largest metros by black population does the black homeownership rate exceed the non-black rate. The smallest margins are found in Fayetteville (15ppts), Orlando(15ppts), Washington (16ppts), Charleston (17ppts), and Miami (18ppts). The largest margins are in Minneapolis (51ppts), Pittsburgh (41ppts), Milwaukee (40ppts), Cleveland (38ppts), and Indianapolis (35ppts).

In general, areas where black residents make up a larger share of the overall population tend to also have higher rates of black homeownership. The large metros with the highest black homeownership rate are Birmingham (52.2%), Washington, D.C. (51.4%), Richmond (49.9%) and Atlanta (48.2%). These metros rank seventh, eighth, fifth and third, respectively, with the highest share of black residents.

There are also some areas where the black homeownership rate is higher than might be expected based solely on the size of area’s black population. San Antonio has the 37th-highest share of black residents among markets included in this analysis, but the black homeownership rate there (42.9%) ranks 14th. The situation is similar in Riverside (15th-highest black homeownership rate; 35th-highest share of black residents), Orlando (6th-highest black homeownership rate; 24th-highest share of black residents) and Sacramento (23rd-highest black homeownership rate; 39th-highest share of black residents).