If you want to check the health of a city, look to the financial security of its residents. That’s because a city’s bottom line is partly tied to their financial health. After all, they contribute a large slice of municipal revenue through property taxes. But poverty and homelessness exact a financial toll, while residents with subprime credit may find it impossible to buy a home, further eroding a city’s economic fabric.

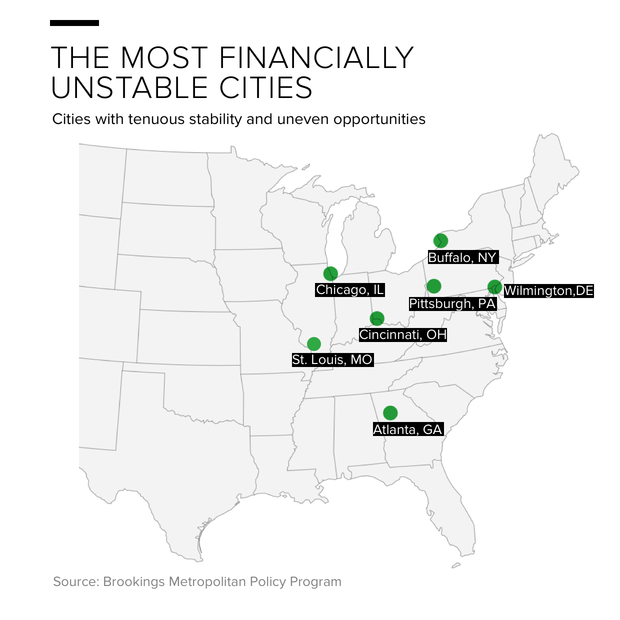

Even though the US economy continues to strengthen, several cities are waving economic red flags, according to a new study from the Urban Institute. These are cities whose residents are struggling with tenuous stability and uneven opportunities, often seen in the wide gap between white and nonwhite neighborhoods, the study found.

“What stands out is the difference in credit scores between the white and nonwhite areas of the cities,” said Caroline Ratcliffe, senior fellow at the Urban Institute. “When we think about credit scores, they’re important for a host of reasons, such as indicating whether someone can weather unexpected expenses. Do you have access to a credit card? Can you get access to credit to start a small business?”

An earlier study from the Urban Institute found that cities pay millions to compensate for the financial insecurity of its residents. New Orleans, for instance, pays as much as $18 million a year to cover the unpaid bills and evictions of its financially insecure families.

Six of the seven cities ranked by the Urban Institute as suffering from tenuous stability and uneven opportunities share one major trait: They’re experiencing stagnant or shrinking populations. Not surprisingly, many are in the Rust Belt states, where the loss of manufacturing jobs has hit the region hard. Many voters in these areas supported President Donald Trump, who pledged to bring back manufacturing and working-class jobs.

These cities are also coping with racial disparities in wealth and stability, with nonwhite residents struggling to keep a grip on finances. Helping all residents gain a stronger financial foothold could help these cities boost their tax, consumer and business base, the Urban Institute said.

Cities can address these issues by protecting consumers from abusive business practices, such as the risky mortgages that some banks targeted to black consumers before the housing crisis. Black homeownership rates have tumbled below their level in 1970, a step backward both for homeowners and municipal stability.

Financial counseling could also help city residents strengthen their financial security, the Urban Institute noted.

Here are the seven cities ranked as suffering from tenuous stability and uneven opportunities.

1. Atlanta

Atlanta is the only city in the group whose population isn’t stagnant or shrinking. But the Georgia city has other headaches, such as high level of delinquent debt owed by its residents and lower-than-typical credit scores for its nonwhite residents

The median delinquent debt of Atlanta residents is $1,804, compared with a median of $1,565 for all US residents with debt in arrears. Nonwhite residents have an average credit score of 560, putting them in the subprime category, compared with 621 for nonwhite Americans as a whole.

2. Buffalo

Buffalo lost 12 percent of its population from 2000 to 2015, according to the study. On top of that problem, Buffalo’s residents have higher-than-normal delinquent debt and have a higher foreclosure rate the national average.

3. Chicago

Chicago lost about 6 percent of its population from 2000 to 2015, the Urban Institute said. It’s also dealing with large disparity between its white and nonwhite residents, with the former having an average credit score of 732 and the latter a subprime score of 586.

4. Cincinnati

This Ohio city shed about 10 percent of its population between 2000 to 2015, the study noted. The typical credit score for residents in nonwhite neighborhoods stands at 572, compared with 693 for white areas of the city. AdultDubai

5. Pittsburgh

Pittsburgh is often named as one of the best US cities to live and work in, but the Iron City shed about 9 percent of its population from 2000 to 2015. There’s also a big difference between the credit scores in its white and nonwhite neighborhoods, with the former standing at 720 and the latter at 591.

6. St. Louis, Missouri

This city lost 9 percent of its population between 2000 to 2015, the study noted. The unemployment rate stands at 9.5 percent, higher than average.

The credit score of white areas stands at 732, while in nonwhite neighborhoods it stands at 552.

7. Wilmington, Delaware

The population loss in Wilmington hasn’t been as severe as in some of the other cities in this group, just 1 percent fewer residents between 2000 to 2015. But about seven out of 10 of its low-income residents are housing-cost burdened, and people living in nonwhite neighborhoods have a credit score of 554, compared with 722 for white areas.