How America’s Housing System Undermines Wealth Building in Communities of Color

By Danyelle Solomon, Connor Maxwell, and Abril Castro

This report is part of a series on structural racism in the United States.

Authors’ note: CAP uses “Black” and “African American” interchangeably throughout many of our products. We chose to capitalize “Black” in order to reflect that we are discussing a group of people and to be consistent with the capitalization of “African American.”

Homeownership and high-quality affordable rental housing are critical tools for wealth building and financial well-being in the United States. Knowing this, American lawmakers have long sought to secure land for, reduce barriers to, and expand the wealth-building capacity of property ownership and affordable rental housing. But these efforts have almost exclusively benefited white households; often, they have removed people of color from their homes, denied them access to wealth-building opportunities, and relocated them to isolated communities. Across the country, historic and ongoing displacement, exclusion, and segregation continue to prevent people of color from obtaining and retaining their own homes and accessing safe, affordable housing.

For centuries, structural racism in the U.S. housing system has contributed to stark and persistent racial disparities in wealth and financial well-being, especially between Black and white households. In fact, these differences are so entrenched that if current trends continue, it could take more than 200 years for the average Black family to accumulate the same amount of wealth as its white counterparts. While homeownership and affordable housing are not a panacea for eliminating entrenched racial inequality, lawmakers must make amends for past and present harms by enacting new laws designed to expand access to prosperity for all Americans.

This report examines how government-sponsored displacement, exclusion, and segregation have exacerbated racial inequality in the United States. It first looks at how public policies have systematically removed people of color from their homes. It then considers how federal, state, and local policies have fortified housing discrimination. The final section of the report proposes targeted solutions that would help make the U.S. housing system more equitable.

In 1845, the term “manifest destiny” emerged to describe the commonly held belief that white settlement and expansion across North America was inevitable and even divinely ordained. But long before then, this ideology provided the justification for ethnic cleansing and systematic displacement. In many ways, it continues to inform policymaking to this day. This section considers examples within Native American and Black communities.

Although American public policies had intentionally displaced people of color for centuries prior, two of the most well-known examples are the Indian Removal Act and the Dawes Act. President Andrew Jackson signed the Indian Removal Act into law in 1830, authorizing the federal government to forcibly relocate Native Americans in the southeast in order to make room for white settlement. For the next two decades, thousands of Native Americans died of hunger, disease, and exhaustion on a forced march west of the Mississippi River—a march now known as the “Trail of Tears.” Decades later, in 1887, President Grover Cleveland signed into law the General Allotment Act—better known as the Dawes Act. The Dawes Act forcibly converted communally held tribal lands into small, individually owned lots. The federal government then seized two-thirds of reservation lands and redistributed the land to white Americans. Native American families who were allotted land were encouraged to take up agriculture despite the fact that much of the land was unsuitable for farming and many could not afford the equipment, livestock, and other supplies necessary for a successful enterprise. The result was the erosion of tribal traditions, the displacement of thousands of families, and the loss of 90 million acres of valuable land.

But the systematic removal of Native Americans did not end in the 1800s: Between 1945 and 1968, federal laws terminated more than 100 tribal nations’ recognition and placed them under state jurisdiction, contributing to the loss of millions of additional acres of tribal land. During this period, lawmakers again encouraged Native Americans to relocate—this time from reservations to urban centers, resulting in economic hardships and housing instability.

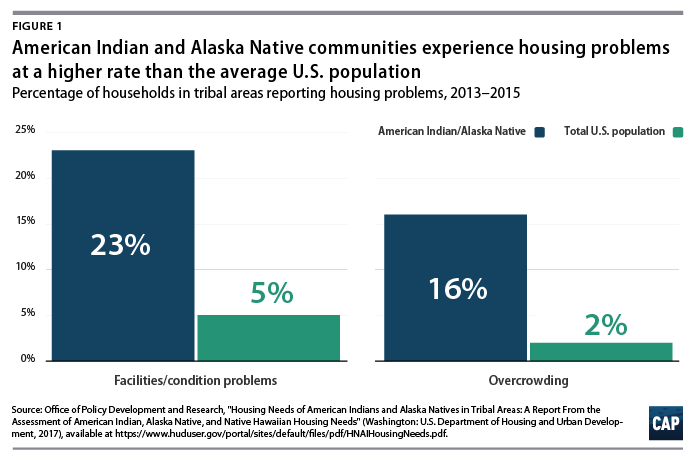

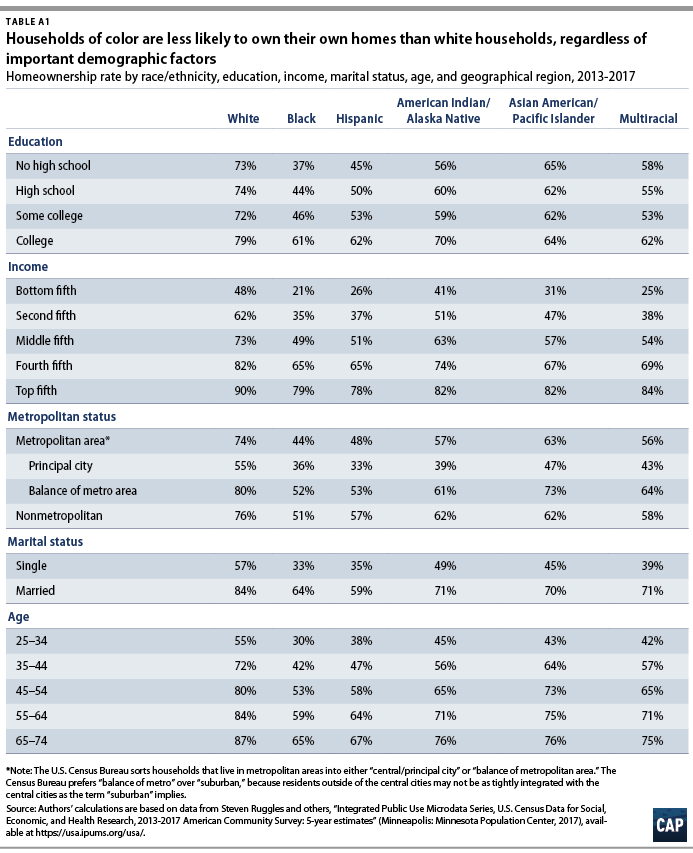

While tribal nations have experienced a resurgence in self-governance and self-determination in recent decades, the legacy of displacement, oppression, and neglect in American public policy affects Native communities to this day. (see Figure 1) Native people endure some of the highest levels of financial insecurity in the country. In 2017, more than 1 in 5 American Indian and Alaska Native (AI/AN) people—22 percent—lived in poverty, compared with just 8 percent of white Americans. AI/AN people are also less likely than their white counterparts to own their own homes and are more likely to be burdened by the cost of housing. (see Figure A1) Even when AI/AN people do own homes, they are often worth less than those of their white counterparts; the median home value for AI/AN people is $135,200, while the median home value for white people is $219,600. These blatant disparities in housing and economic well-being are due, in part, to past public policies informed by manifest destiny that stripped Native communities of land, wealth, and opportunity.

While Native Americans have long been the primary target of government-sponsored land redistribution, other communities of color—especially Black communities—have experienced and continue to experience displacement as well. For Black communities in urban areas, public policies have often been enacted under the guise of creating new public spaces, combating urban blight, or bolstering economic development. But over time, these policies have stripped Black communities of the wealth and financial stability found in property ownership and affordable rental housing. For example, in the early 1850s, New York City lawmakers used eminent domain to destroy a thriving predominantly Black community in Manhattan, displacing thousands of residents in order to create the public space known today as Central Park. And just 30 years ago, Atlanta lawmakers demolished the United States’ oldest federally subsidized affordable housing project, displacing more than 30,000 predominantly Black families to create Centennial Olympic Park. These are just two examples of the countless policies that have displaced Black communities for the so-called benefit of the greater population. But there is scant evidence that Black Americans see long-term benefits from these revitalization efforts.

For much of the 20th century, federal, state, and local policies subsidized the development of prosperous white suburbs in metropolitan areas across the country. They also constructed new highway systems—often through communities of color—to ensure access to job opportunities in urban centers for primarily white commuters. Over time, however, changing tastes and growing displeasure with congested roadways have resulted in middle-class and wealthy white households’ relocation to cities. As lawmakers rush to redevelop previously neglected urban neighborhoods, many of the same communities of color that were denied access to suburban homeownership and displaced by highway projects are again being forced from their homes to make room. Indeed, although lawmakers could construct more affordable housing units and create programs to insulate longtime city residents from the disruptive effects of gentrification, many appear to draw heavily from the ideology of manifest destiny—that white settlement and expansion are inevitable—in their responses to such rapid redevelopment.

Merriam-Webster defines gentrification as “the process of repairing and rebuilding homes and businesses in a deteriorating area … accompanied by an influx of middle-class or affluent people and that often results in the displacement of earlier, usually poorer residents.” Over the past 50 years, this process, which sometimes involves government investment, has taken root in dozens of cities across the country. Increasing demand for housing, along with reduced levels of housing production, has contributed to staggering increases in rental and purchase prices in urban areas across the United States. While some experts cite the economic benefits of gentrification, many recognize its role in exacerbating racial inequality, as well as in the suburbanization of poverty as low-income people are forced to relocate from cities to the areas outside them.

Nowhere are the effects of gentrification more noticeable than the nation’s capital, Washington, D.C. Between 1970 and 2015, Black residents declined from 71 percent of the city’s population to just 48 percent. The city’s white population increased by 25 percent during the same period. From 2000 to 2013, the city endured the nation’s highest rate of gentrification, resulting in more than 20,000 African American residents’ displacement. Today, almost 1 in 4 Black Washington residents—23 percent—live in poverty. By contrast, just 3 percent of white Washington residents live in poverty—a lower white poverty rate than in any of the 50 states. Without intervention, present trends will likely persist, further diminishing homeownership and affordable rental opportunities for long-time Washington residents.

American lawmakers have long touted the importance of property ownership, affordable housing, and economic development. However, policymaking has too often coincided with the systematic removal of people of color from their homes and communities. Historic and ongoing displacement has destabilized communities and exacerbated racial disparities in economic indicators of well-being. These government policies, combined with the exclusion and segregation discussed in the following section of this report, are causes and consequences of entrenched structural racism in the U.S. housing system.

For decades, governments and private citizens have employed exclusionary tactics to prevent African Americans and other people of color from building wealth through homeownership and affordable housing. Whether through formal policy decisions or a persistent failure to enact and enforce civil rights laws, government action and inaction continues to undermine prosperity in communities of color.

As noted in a recent Center for American Progress report, “Racial Disparities in Home Appreciation,” the federal government established several programs in the 20th century that were designed to promote homeownership and provide a pathway to the middle class. However, these programs largely benefited white households while excluding Black families.

In 1933 and 1934, in the midst of the Great Depression, President Franklin Delano Roosevelt signed the Home Owners’ Loan Act and the National Housing Act into law to prevent foreclosures and make rental housing and homeownership more affordable. To carry out these missions, the newly minted Home Owners Loan Corporation (HOLC) created maps to assess the risk of mortgage refinancing and set new standards for federal underwriting. The Federal Housing Administration (FHA) used these maps to determine the areas in which it would guarantee mortgages. But HOLC maps assessed risk in part based on a neighborhood’s racial composition, designating predominantly nonwhite neighborhoods as hazardous, and coloring these areas red. This process, known as redlining, denied people of color—especially Black people—access to mortgage refinancing and federal underwriting opportunities while perpetuating the notion that residents of color were financially risky and a threat to local property values. As a result, just 2 percent of the $120 billion in FHA loans distributed between 1934 and 1962 were given to nonwhite families. Today, approximately 3 in 4 neighborhoods—74 percent—that the HOLC deemed “hazardous” in the 1930s remain low to moderate income, and more than 60 percent are predominantly nonwhite. In short, while federal intervention and investment has helped expand homeownership and affordable housing for countless white families, it has undermined wealth building in black communities.

In 1944, President Roosevelt signed into law the Servicemen’s Readjustment Act—commonly referred to as the GI Bill—which provided a range of benefits, such as guaranteed mortgages, to veterans of World War II. However, according to historian Ira Katznelson, “the law was deliberately designed to accommodate Jim Crow.” For instance, the GI Bill allowed local banks to discriminate against Black veterans and deny them home loans even though the federal government would guarantee their mortgages. In Mississippi, just two of the 3,000 mortgages that the Veteran’s Administration guaranteed in 1947 went to African Americans, despite the fact that African Americans constituted half of the state’s population. While the GI Bill paved the way for millions of predominantly white veterans to enter the middle class, it also further entrenched the United States’ racial hierarchy.

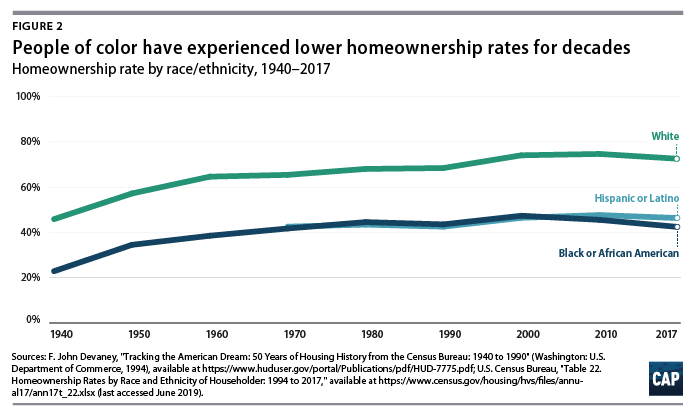

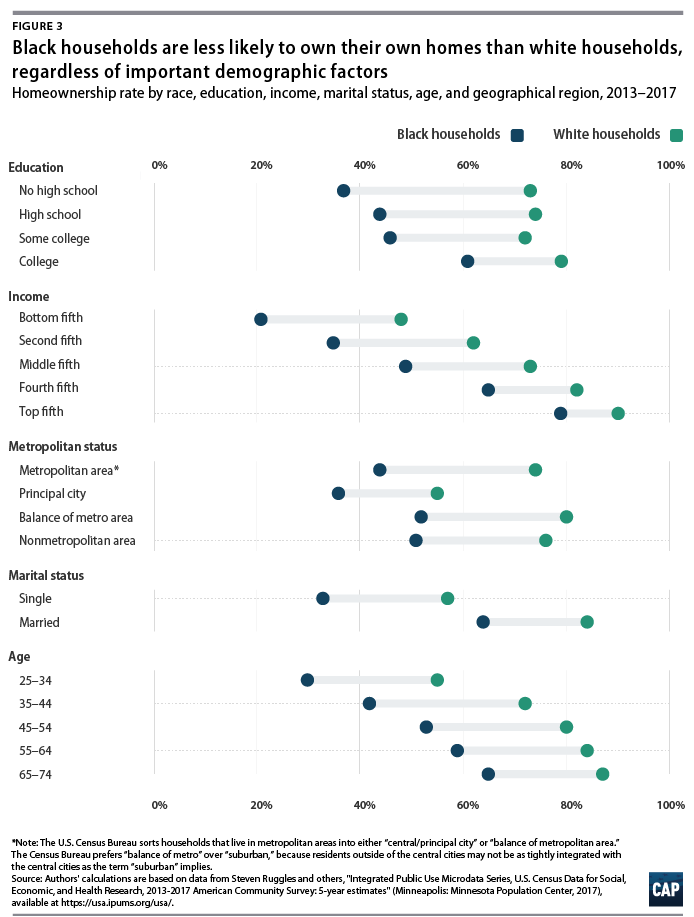

Federal home loan programs allowed households—the majority of them white—to build and transfer assets across generations, contributing to glaring racial disparities in homeownership and wealth. (see Figure 2) Today, households of color remain less likely to own their own homes when compared with white households, even after controlling for protective factors such as education, income, age, geographical region, state, and marital status. The disparity between Black and white households is particularly pronounced. (see Figure 3) Just 41 percent of Black households own their own home, compared with more than 73 percent of white households. In fact, college educated Black people are less likely to own their own homes than white people who never finished high school. Intentional exclusion from federal programs has produced structural barriers to homeownership that continue to undermine wealth accumulation in communities of color. Today, the typical white household has 10 times more wealth than the typical Black household.

For much of the 20th century households of color were systematically excluded from federal homeownership programs, and government officials largely stood by as predatory lenders stripped them of wealth and stability.

In the decades preceding the Fair Housing Act, government policies led many white Americans to believe that residents of color were a threat to local property values. For example, real estate professionals across the country who sought to maximize profits by leveraging this fear convinced white homeowners that Black families were moving in nearby and offered to buy their homes at a discount. These “blockbusters” would then sell the properties to Black families—who had limited access to FHA loans or GI Bill benefits—at marked-up prices and interest rates. Moreover, these homes were often purchased on contracts, rather than traditional mortgages, allowing real estate professionals to evict Black families if they missed even one payment and then repeat the process with other Black families. During this period, in Chicago alone, more than 8 in 10 Black homes were purchased on contract rather than a standard mortgage, resulting in cumulative losses of up to $4 billion. Blockbusting and contract buying were just two of several discriminatory wealth-stripping practices that lawmakers permitted in the U.S. housing system.

A recent CAP report, “Racial Disparities in Home Appreciation,” highlighted that although the Fair Housing Act banned discriminatory housing practices, many lenders continue to unfairly target people of color with limited federal, state, and local oversight or accountability. At the turn of the century, banks disproportionately issued speculative loans to Black and Latinx homebuyers, even when they qualified for less risky options. These “subprime loans” had higher-than-average interest rates that could cost homeowners up to hundreds of thousands of dollars in additional interest payments. During the financial crisis, Black and Latinx households lost 48 percent and 44 percent of their wealth, respectively, due in part to these practices.

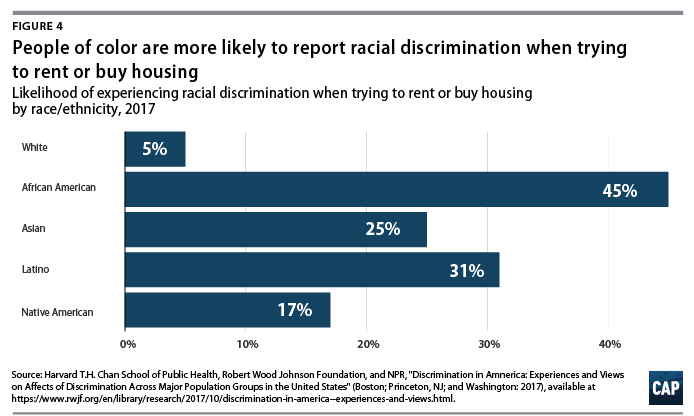

People of color continue to endure rampant discrimination in the housing market: 17 percent of Native Americans, 25 percent of Asian Americans, 31 percent of Latinos, and 45 percent of African Americans report experiencing discrimination when trying to rent or buy housing. (see Figure 4) By contrast, just 5 percent of white Americans report experiencing housing discrimination. Racial bias not only undermines access to housing but can also affect property values. One study found that homes in Black neighborhoods were undervalued by an average of $48,000 due to racial bias, resulting in $156 billion in cumulative losses nationwide. Clearly, federal, state, and local lawmakers could do more to ensure that all Americans—regardless of background—have access to homeownership and affordable housing.

More than 50 years after the Fair Housing Act’s passage, most American communities remain segregated by race. Existing residential patterns are largely not the result of personal preference among people of color to live in ethnic enclaves, but rather centuries of policies enacted by lawmakers on every level. Racial segregation has contributed to persistent disparities in access to public goods—such as parks, hospitals, streetlights, and well-maintained roads—and has undermined wealth building in communities of color nationwide.

Perhaps the clearest—but least recognized—example of government-backed segregation was the creation of Chinatowns across the continental United States. More than 150 years ago, thousands of Chinese immigrants arrived in the American West to construct the first transcontinental railroad and participate in the California gold rush. But as they moved into urban areas in search of work, they were met by violent and xenophobic resistance. Lawmakers largely stood by as mobs terrorized Chinese communities and even enacted legislation that restricted Chinese immigrants’ employment opportunities, limited their mobility, and prohibited them from voting or purchasing property. With few safe housing options available, Chinese residents concentrated in ethnic ghettos that demanded almost complete self-sufficiency to survive. Chinatowns were generally not created as the result of a natural tendency to self-segregate, but rather due to various federal, state, and local policies prohibiting Chinese Americans from fully participating in the United States’ housing and employment markets.

During this period, lawmakers also enacted policies to separate African Americans from white Americans. Long before redlining offered an economic incentive to segregate communities, local governments relied on, among other policies, zoning ordinances to keep races apart. Explicit race-based zoning emerged in 1910 with formal prohibitions on African Americans purchasing property on majority-white blocks, and vice versa. While the U.S. Supreme Court outlawed race-based zoning in 1917, its rationale—that the practice limited white homeowners’ ability to sell their property—encouraged localities to develop innovative new segregation strategies.

Over time, single-family zoning emerged and replaced race-based zoning as one of the most popular local governing tools for segregating American communities. This policy prevented the construction of apartment buildings and multifamily units in certain neighborhoods, ensuring that only those who could afford single-family homes could live there. As white households typically had higher incomes and access to a range of federal home loan programs, single-family zoning produced racially segregated neighborhoods without explicit race-based ordinances. With a greater tax base and support from federal programs, these areas could afford public goods that others could not and, as a result, experienced greater real estate appreciation. At the same time, city planners zoned areas adjacent to neighborhoods with apartment buildings and multifamily units—which were predominantly low-income and Black—for industrial and commercial use. These zoning decisions concentrated poverty and exposed vulnerable people to dangerous environmental hazards. This all but ensured that property values in these communities would appreciate at much slower rates. Single-family zoning persists to this day and helps maintain existing patterns of racial segregation in communities across the country.

Over time, single-family zoning emerged and replaced race-based zoning as one of the most popular local governing tools for segregating American communities. This policy prevented the construction of apartment buildings and multifamily units in certain neighborhoods, ensuring that only those who could afford single-family homes could live there. As white households typically had higher incomes and access to a range of federal home loan programs, single-family zoning produced racially segregated neighborhoods without explicit race-based ordinances. With a greater tax base and support from federal programs, these areas could afford public goods that others could not and, as a result, experienced greater real estate appreciation. At the same time, city planners zoned areas adjacent to neighborhoods with apartment buildings and multifamily units—which were predominantly low-income and Black—for industrial and commercial use. These zoning decisions concentrated poverty and exposed vulnerable people to dangerous environmental hazards. This all but ensured that property values in these communities would appreciate at much slower rates. Single-family zoning persists to this day and helps maintain existing patterns of racial segregation in communities across the country.

The harmful effects of government-backed segregation also produced racial inequities in access to public spaces, public goods, and increased exposure to environmental hazards. Communities of color often have less access to grocery stores, child care facilities, and other important neighborhood resources. They are also more likely to have hazardous waste facilities in close proximity. These disparities—along with the chronic devaluation of Black-owned property—contribute to differences in home values and appreciation. While the median white homeowner’s property is worth $219,600, the median Black homeowner’s property is worth just $152,700. As noted in CAP’s recent report, white homeowners also have more than double the mean net housing wealth—home value minus debt—of Black homeowners: $215,800 compared with just $94,400. Overall, segregation fueled the wealth-building capacity of white communities while simultaneously undermining wealth accumulation and economic well-being in communities of color.

Across the country, historic and ongoing displacement, exclusion, and segregation prevent people of color from obtaining and retaining homeownership, as well as accessing safe, affordable housing. Even when they succeed in purchasing their own homes, people of color—especially Black people—often experience lower returns on their investment. They are also more likely to experience foreclosure, often due to predatory lending practices. favicongenerator.org In addition, the cost of rental housing has outpaced wages and destabilized longtime residents’ ability to afford their homes.

While homeownership and affordable rental housing are not panaceas for addressing entrenched structural inequality, it is clear that lawmakers must make amends for past and present harms inflicted on communities of color in the U.S. housing system. CAP has previously called on lawmakers to significantly expand the supply of affordable units and dismantle existing exclusionary zoning practices. These efforts must also coincide with policies that promote access to resources and opportunity among residents of color. Moreover, lawmakers should support robust civil rights enforcement in the housing market by fully implementing the Affirmatively Furthering Fair Housing rule, applying disparate impact assessments to housing discrimination cases, and modifying the mortgage appraisal process. Lawmakers should also reexamine current Federal Emergency Management Agency and disaster relief regulations to promote environmental justice and equitable recovery policies.

These policies will not make amends for centuries of injustice in the housing market; however, they would represent affirmative steps toward racial equity in the U.S. housing system.

Credits: Center For American Progress