Why So Many Black Property Owners in Central Brooklyn Are Losing Their Homes, Explained

Part 1 in a series: The difference between deed theft and the city’s controversial Third Party Transfer Program

Black homeowners in Central Brooklyn are losing their homes at an alarming rate, and the main culprits are deed theft and the city’s controversial Third Party Transfer Program.

As of March 2019, there were at least 6,000 foreclosures pending in Kings County with more are on the way, according to Catherine Isobe, senior staff attorney at Brooklyn Legal Services. Bedford-Stuyvesant, Crown Heights and East New York have some of the highest rates of real estate fraud, along with Canarsie and Flatlands, according to legal advocates

Residents may feel like the two offenders are one in the same. But while both result in similar outcomes, Third Party Transfer and deed theft are two separate concerns.

What Is Third Party Transfer?

Third Party Transfer is a city program in which “distressed” vacant or occupied properties are foreclosed by the city and given to a qualified sponsor, a non-profit or for-profit building developer, to rehabilitate it for affordable housing.

NYC Housing Preservation and Development launched TPT in 1996, when abandoned buildings were a common sight in New York. The central motivation was to collect unpaid taxes and bills from negligent landlords and foreclose derelict housing units, fix them up, and rent them out to tenants at low- to mid-incomes.

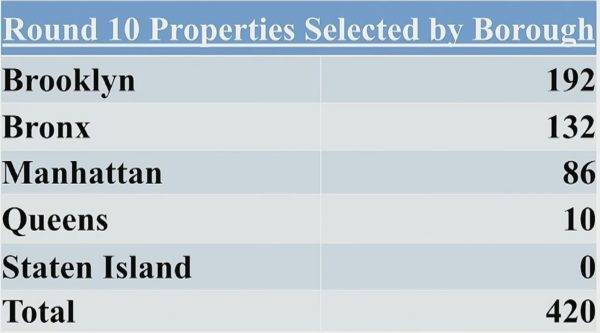

In recent years, the program has led to black home-owners and other small property owners in Central Brooklyn neighborhoods losing their homes over unpaid bills at a mere fraction of their properties’ value, sparking calls of outrage about the “overly broad and improper” use of the TPT program.

Many of the Crown Heights and Bed-Stuy homeowners who lost or nearly lost their homes are senior citizens who had made clerical errors. Others have lost millions of dollars worth of equity to the city for issues as minimal as late payments for water bills.

“This program, which was supposed to be used to help preserve affordable housing, has been a subterfuge to remove properties from homeowners who had their properties, in some cases, for more than thirty years,” said Brooklyn Borough President Adams who has helped lead the charge to investigate and curb the program.

Other elected officials calling for an investigation and reevaluation of the program include Councilmember Robert Cornegy of Bed-Stuy and Crown Heights, who argues the difference between the properties’ values and the charges owed to the city are grossly disproportionate; and State Senator Velmanette Montgomery , whose “ Deed Theft Bill ” aims to grant greater protections to home-owners either in default or foreclosure. Montgomery’s bill currently is pending Gov, Cuomo’s signature.

A $66 million ongoing lawsuit against HPD claims the TPT program is illegal. Pending this lawsuit, the program may be halted or reversed and the question of reparations would likely follow.

HPD, on the other hand, maintains that the program is a success:

“In addition to being an effective tax enforcement program, TPT has become a critical tool for protecting tenants, and is one that we can’t afford to lose in the midst of a dire affordability crisis,” said HPD commissioner Louise Carroll, as reported in the Brooklyn Daily Eagle.

What Is Deed Theft?

Instances of mortgage fraud or deed theft have swept through Brooklyn in recent years. Unlike TPT, deed theft is an outright illegal activity and punishable by law. Several activities may fall under the umbrella terms “ mortgage fraud ,” “ deed theft ” and “deed fraud” but an easy way to understand them is they occur primarily through deception.

Identity theft, scams, someone posing as a borrower, someone misrepresenting financial information — these are a few of the most common ways mortgage fraud and deed theft can manifest.

Scammers often target the elderly or homeowners who speak English as a second language, because they may be easier to manipulate. Scammers also target homeowners in financial distress, in debt or falling badly behind on taxes and bills, because they may be desperate for a quick fix to their monetary troubles.

Targeted homeowners may be aware of the threat of TPT and will take offers from schemers in order to avoid home foreclosure.

It is possible that scam artists are exploiting the confusion and tension surrounding the city’s TPT program, invoking it as an imminent threat while making offers, in order to steer homeowners into bad deals.

A recent example of deed fraud involves a man who had been tricked into selling the deed to his $1.5 million dollar home for $650,000 to a man claiming to help him with his debts.

In another instance , someone hired to care for an 85-year-old diabetic man convinced the senior to sign away the deed to his East New York home. The caretaker was indicted for grand larceny and identity theft in January, according to Gothamist.

If you are a homeowner in default or foreclosure, familiarize yourself with the rights granted to you under the Home Equity Theft Prevention Act (HETPA). The act means to protect you from illegitimate buyers.

And as always, maintain a healthy degree of skepticism if anyone shows up suddenly, offering to help you with financial problems.